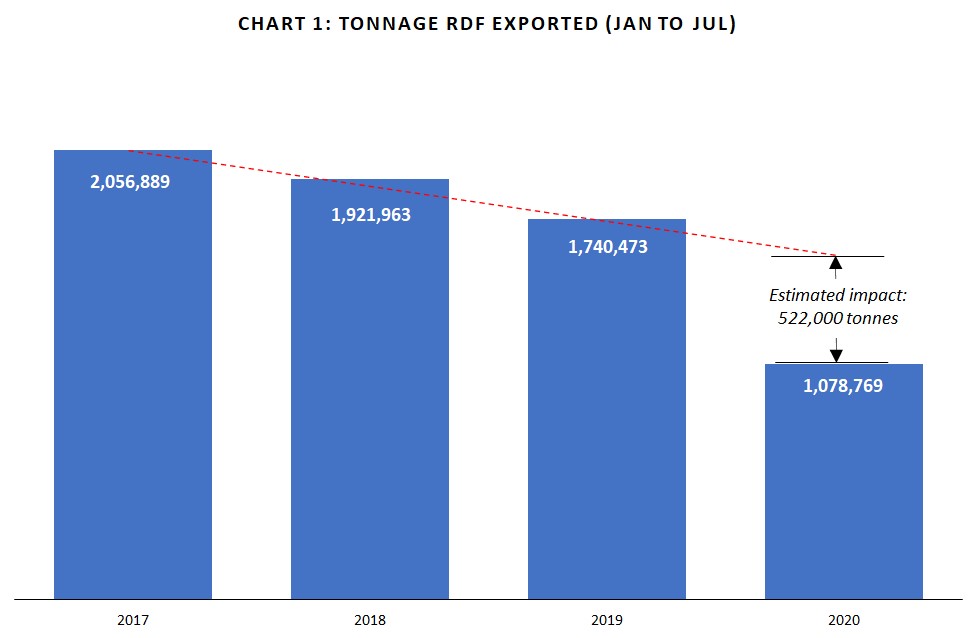

Exports of refuse derived fuel (RDF) in the first seven months of the year have fallen by nearly 700,000 tonnes, compared to the same period in 2019.

The significant fall over the period has been reported by environmental consultancy Footprint Services using the latest 2020 Environment Agency figures.

Environment Agency data suggests 1,078,769 tonnes of RDF was exported the UK from January to July 2020

The consultancy’s data show that 1,078,769 tonnes of RDF was exported the UK from January to July 2020. Between January and July 2019, 1,740,473 tonnes of RDF was exported.

Footprint Services suggests there are myriad factors explaining the decreased export of RDF and solid recovered fuel (SRF), including increased domestic infrastructure for energy from waste (EfW).

‘Many factors’

Andrew Gadd, company manager at Footprint Services, said: “There are many factors taking their toll on RDF/SRF exports, such as the increase in domestic EfW capacity, the Dutch waste import tax, other transboundary movements such as SRF from Germany to Denmark or Italy to the Netherlands and, of course, the coronavirus impact.

“These aspects combine to a greater degree on the lower-grade RDF, where the future is perhaps uncertain.

“If the current trend in building EfW in the UK continues, then, logically, that will cannibalise the feedstock currently going overseas.”

Graph shows how RDF exports have declined. The dotted line shows where Footprint Services expects exports to be each year

Exports

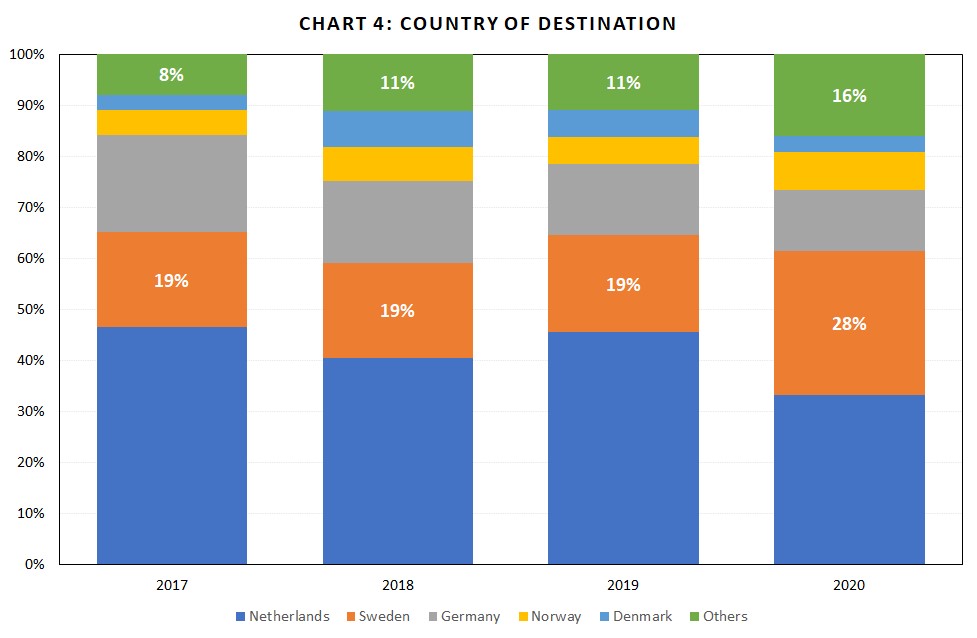

This year has also seen the destinations for exports from the UK shift dramatically, Footprint Services suggests. Analysis of the EA data shows the percentage of RDF exported to Sweden has risen from 19% in 2019 to 28% in 2020. By contrast, the percentage exported to the Netherlands has dropped significantly since the introduction of its RDF tax (see letsrecycle.com story).

The market share taken by Scandinavia in general has risen from 30% in 2019 to 39% this year.

Graph shows percentage market share for RDF exports’ country of destination (source: Footprint Services)

SRF

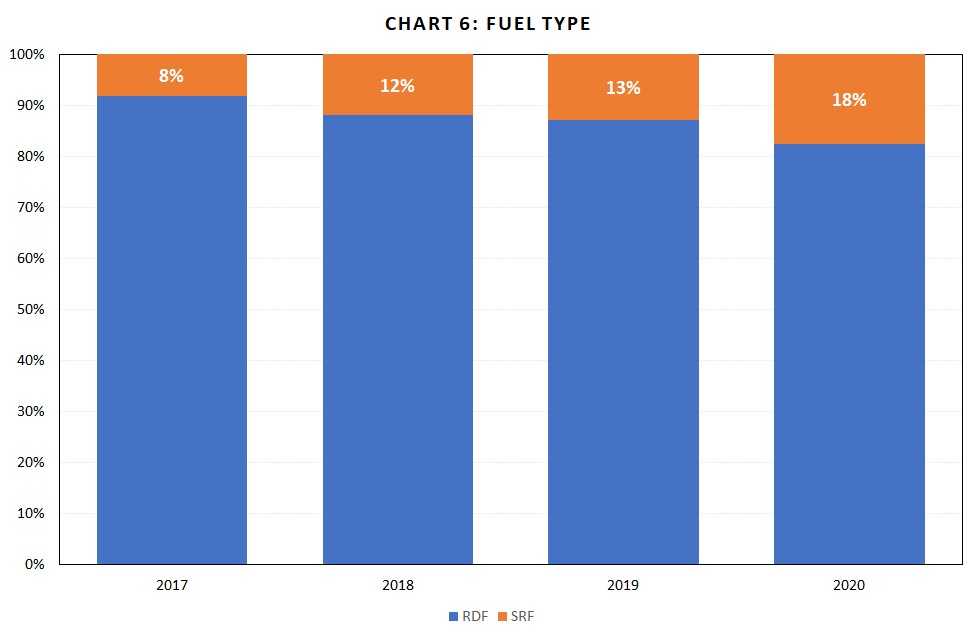

Exports of SRF have not suffered as greatly as those of RDF with SRF a more refined grade used primarily for cement kilns.

The three most common destinations for UK exports of SRF are Eastern Europe, Southern Europe and Scandinavia, Footprint Services says. The consultancy claims the ‘relative robustness’ of the markets in these destinations explains why exports of SRF have not fallen as much.

In 2019 SRF accounted for 13% of exports versus RDF; in 2020 this has risen to 18%.

Mr Gadd said: “The resilience of the SRF production/export figures in the face of significant global turbulence indicates great promise for this form of fuel, as the cement industry seeks ways to make their product in a cleaner, less impactful way.

“The overriding trend to reduce dependence on fossil fuels and minimise pollution gives a sense of optimism for the future strength of SRF exports.”

Graph shows changing percentages of type of fuel exported during the past few years (graph: Footprint Services)

The post Sharp fall in RDF exports up to July 2020 appeared first on letsrecycle.com.

Source: letsrecycle.com Waste Managment