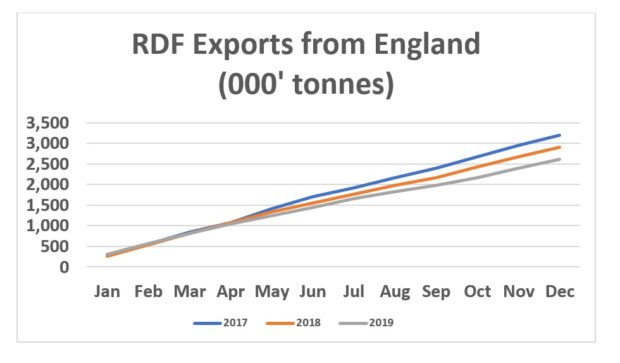

Statistics published by the Environment Agency suggest that the amount of Refuse Derived Fuel (RDF) exported from England in 2019 has fallen by more than 10% compared to 2018.

The figures, which are provisional until finalised later this year, were published on 16 December and cover the calendar year to November.

They show that for the first 11 months of 2019, 2,397,144 tonnes of RDF were exported abroad, down from 2,678,946 from the same period in the previous year, a fall of 10.5%.

Applying the same reduction to December 2019 RDF exports, it would suggest a total of 2,617,210 tonnes of RDF was exported in 2019, a fall of nearly 300,000 tonnes from the 2,898,707 figure recorded for 2018.

Chart above shows cumulative export volumes for 2017-2019 (estimate for Dec 2019)

If this fall proves to be the case (subject to the December data), it will also highlight a continued fall in RDF exports since the end of the 2017 calendar year, where 3,200,788 tonnes were exported.

Market

The latest data has statistics from October and November 2019, which show that the Netherlands remains the biggest market with large volumes also going to Sweden, Germany and Denmark.

Among the largest single monthly exporters were Bertling, sending 20,000 tonnes to Sweden in November, and Biffa which sent 20,000 to the Netherlands in October.

“There will be a reshuffle of the residual waste streams, with some more waste being landfilled in the UK”

Taxes

The latest figures come after two major destinations for RDF exports, the Netherlands and Sweden, approved climate change taxes relating to the incineration of waste for energy recovery.

Sweden will bring in a 75Kr (£6) per tonne tax on “waste that is burnt”, which will include (RDF) imported from the UK from April while the Netherlands imposed its €32 tax on waste exported for incineration from the beginning of January.

Outlook

Commenting on the outlook for 2020, Robert Corijn, chair of the UK’s RDF Industry Group and marketing manager of Dutch operator Attero, said that volumes exported might continue to fall. “I think there will be a reshuffle of the residual waste streams, with some more waste being landfilled in the UK.”

In terms of exports to Netherlands, Mr Corijn added: “These are likely to reduce but the Netherlands will remain a good outlet for the UK exporters.”

Pressures

Andy Jones, deputy chair of the RDF Industry Group and managing director of Totus Environmental, told letsrecycle.com that the export market has been subject to a number of pressures over the last 12 months and challenging conditions looked set to prevail in 2020.

Mr Jones commented: “The backdrop of relentless conjecture around the commercial and logistical implications of Brexit during 2019 seriously impacted the industry’s ability to plan with any degree of confidence. Then, during last summer, we saw four of the six combustion lines at Amsterdam’s AEB EfW facility temporarily taken out of service. As a result, Dutch authorities took the decision not to consent any renewals or new TfS (Transfrontier Shipment of Waste) until the facility was back online.

However, Mr Jones said the picture wasn’t completely gloomy as the export of RDF would continue to play an “important role” as a route for the UK’s residual waste. But, he said the sector would have to adapt “with material quality, consistency and flexibility playing an increasingly important role. Whilst the days of shredding and shipping black bag waste as RDF are behind us, the development of new markets means that there will continue to be commercially and environmentally sustainable export opportunities for those willing to invest and care about the product they produce.”

The post RDF exports continue to fall in 2019 appeared first on letsrecycle.com.

Source: letsrecycle.com Waste Managment