Viridor’s portfolio of Energy from Waste (EfW) plants are “consistently outperforming investment”, its parent company Pennon said today in its half year results.

And, Pennon said that Viridor’s recycling division is on a “growth trajectory” after an increase in profits.

But Pennon gave a reminder that a full review of its strategic focus, announced in September, is “ongoing” and will conclude in 2020.

Pennon said that Viridor’s recycling division is on a ‘growth trajectory’ after an increase in profits

Released this morning (26 November), the results cover the first half of the 2019/20 financial year to 30 September, and show that despite a 4.6% drop in revenue to £712.4 million for the group – which also includes South West Water – there was a 1% jump in earnings before tax.

There was also a 0.8% increase in profit before tax to £143.7 million for the Pennon Group, when compared with the same period last year.

Viridor

Viridor’s revenue fell by 8.1% to £388.1m in the first half of the financial year, but its profit before tax was £41.9 million, up 15.7% .

“Viridor continues to deliver sustainable growth in UK recycling and residual waste management,” Pennon said in its half year results statement.

The statement added: “Our existing portfolio of EfWs is consistently outperforming our investment case returns. This underpins Pennon’s earnings growth for 2020 and beyond. Our Recycling division is on a growth trajectory with a new plastics processing facility on track to add much needed capacity in the UK market. “

The results added that Viridor is “well positioned” to take advantage of “strong market dynamics and favourable UK policy environment”.

Portfolio

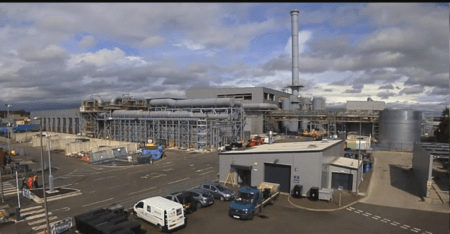

Viridor’s Glasgow facility, which Pennon said will receive ROCs for a period of 20 years from commissioning

The results also gave an update on some of Viridor’s facilities which are yet to come online.

The Glasgow, Beddington and Dunbar EfWs were “taken over towards the end of 2018/19” and the results said the new plants “are progressing through operational ramp-up and optimisation”.

Pennon added that Viridor also received confirmation that the Glasgow facility will receive Renewable Obligation Certificates (ROCs) for a period of 20 years from commissioning.

Markets

In the recycling markets, Viridor’s earnings stood at £7.6 million, up from £7.4 million from last year.

A Pennon statement explained that pricing pressures in the global recycling markets for paper were“offset by Viridor’s continued focus on investing in the most valuable recycling markets”.

“As a result, EBITDA margin has increased by £3 per tonne to £15,” according to the results.

Positive momentum

Chris Loughlin, Pennon chief executive, said the results were positive but reiterated that the strategic review is still “ongoing”, with its conclusion next year.

“Pennon has maintained its positive momentum through the first half of 2019/20, delivering robust performance across our water and waste businesses,” he said.

Commenting on Viridor, Mr Loughlin noted: “Viridor continues to deliver sustainable growth in UK recycling and residual waste management. Our existing portfolio is consistently outperforming our investment case returns.

“This underpins Pennon’s earnings growth for 2020 and beyond. Our Recycling division is on a growth trajectory with a new plastics processing facility on track to add much needed capacity in the UK market. With its diversified complementary operations and unique competitive advantages, Viridor is well positioned to take advantage of strong market dynamics and a favourable UK policy environment.”

The post Pennon profits jump as review looms appeared first on letsrecycle.com.

Source: letsrecycle.com Plastic