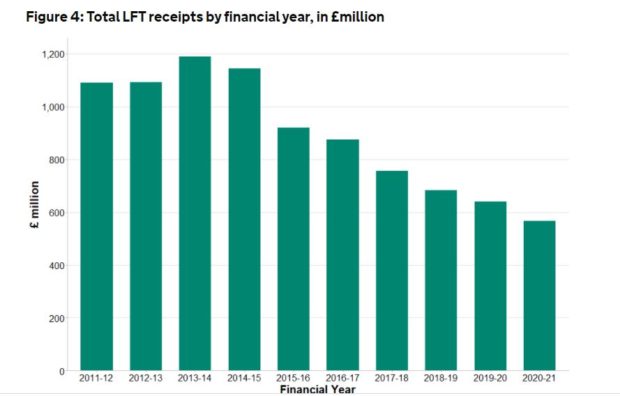

National statistics published by HMRC this week (30 June) show landfill tax receipts fell by 11.9% to £566 million in 2020/21, due to a “steep downward trend” in tonnage over the last decade.

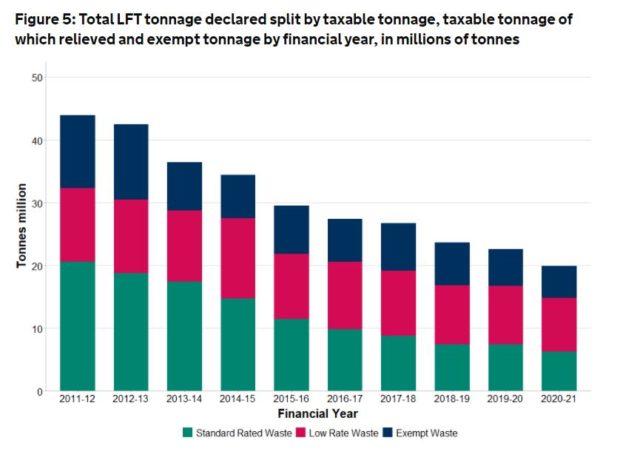

The data also shows that 20 million tonnes of waste were sent to landfill, a fall of 3 million tonnes (12.1%) from 2019/20.

Introduced in 1996, HMRC says landfill tax was the largest environmental tax until the financial year ending in 2015.

It has fallen significantly in recent years, and last year’s fall was the seventh consecutive drop because “less harmful methods of waste management such as recycling and incineration” are now used.

As outlined below, landfill tax receipts have more than halved from £1.189 billion in 2013/14 to £566 million in 2020/21.

Rates

Landfill tax is paid by landfill operators on the disposal of material at a landfill site. The tax is passed on to businesses and local authorities through the gate fee for disposing of waste at a landfill.

As such, it encourages efforts to minimise the amount of material produced and the use of non-landfill waste management options, which may include recycling, composting and recovery.

There is a lower rate of tax which applies to less polluting qualifying materials, and a standard rate which applies to all other taxable material disposed of at authorised landfill sites.

With effect from 1 April 2021, the following rates apply:

Lower rate: £3.10 per tonne

Standard rate: £96.70 per tonne

HMRC says rates have increased year-on-year, demonstrated through the change in the standard rate. The rate increased from £56.00 to £96.70 a tonne between 2011 and 2021, but tax receipts have fallen since the financial year ending in 2014.

However, HMRC says a ‘shortfall’ in landfill tax receipts should not necessarily be considered as a concern because the tax aims to provide an incentive for the diversion of waste from landfill.

Tonnage

As outlined above, standard rate tonnage has shown a steep downwards trend over the last ten years in both number and proportion of landfill tax declarations.

Lower rate tonnage has shown a modest downwards trend in numbers over the last ten years but has increased as a proportion of landfill tax declarations due to falling standard rate tonnage.

Taxes

Other taxes mentioned in the bulletin were the Climate Change Levy (CCL) and and Carbon Price Floor (CPF)

CCL is chargeable on the industrial and commercial supply of taxable commodities for lighting, heating and power in some sectors. CPF is a tax on fossil fuels used in the generation of electricity.

CCL and CPF receipts have fallen in the financial year ending in 2021 from £2.004 billion to £1.715 billion. This was “potentially due to impacts from the government’s response to the Coronavirus pandemic, as national lockdown policies most likely reduced the demand for energy amongst commodities covered by CCL and CPF”.

The aggregates levy of £2 a tonne covers digging, dredging or importing aggregate commercially in the UK. This fell from just under £400 million in 2019/20 to £359 million in 2020/21

The post Landfill tax receipts plummet in 2020/21 appeared first on letsrecycle.com.

Source: letsrecycle.com Waste Managment