Ricky Thomas, M&A specialist at James Cowper Kreston, takes a look at some of the waste and recycling industry mergers and acquisitions during 2019.

2019 appears to have been another good year in the M&A market for independent waste operators. There are a number of private equity-backed businesses which are competing with Biffa, Veolia, and the other big operators for deals.

Overall it can be considered that the market remains quite buoyant despite commodity price pressures which were particularly acute later in the year. The number of infrastructure transactions has been lower in 2019 but we have seen the consolidation of collection operations, which we expect to continue.

Private equity’s influence

There have been a series of moves in recent years by private equity-backed businesses. The two most active this year have been Exponent-backed Enva and Reconomy backed by EMK Capital. Reconomy’s acquisition of Valpak (Dec-18) was followed by three acquisitions in just three-weeks in Nov-19 in addition to Prismm (Apr-19). Enva has continued to expand following the acquisition of Hadfield Wood Recycling (Dec-18) with five acquisitions in the year. These have been across a range of geographies and waste streams.

One exit from the industry was the sale of Raymond Brown Skips by Elysian to R Collard Limited (Nov-19). This marks a further strengthening of the R Collard business following the acquisition of the family business of M Collard in 2016.

Larger businesses

Biffa has continued to lead the charge in consolidation of the industrial and commercial collections market. This has been driven by the £26m acquisition of broker SWRnewstar (Mar-19) and followed by a number of smaller acquisitions including acquisitions from Kier and number of owner-managed businesses. Biffa continues to target 2.5% revenue growth by acquisition, so expect to see some more deals in 2020.

Veolia has acquired at least four businesses in the year including the trade and assets of Glazewing’s commercial collections business and in a strong finish to the year the trade waste and recycling business of Mick George. These acquisitions have added both revenue and footprint to Veolia’s operations with a number of sites in the East of England.

The statistics

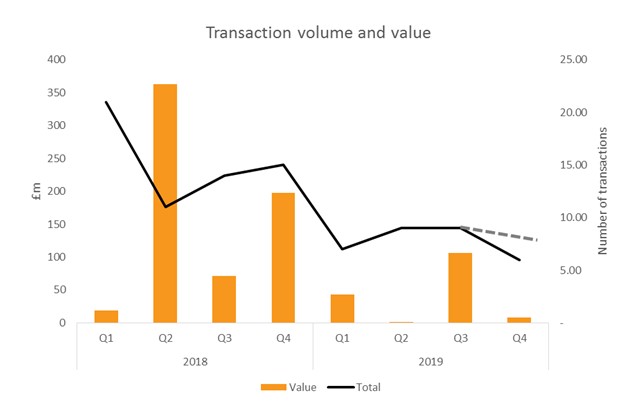

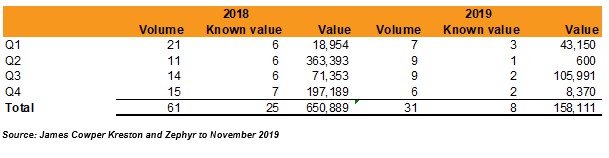

2018 was characterised by some large infrastructure related acquisitions in the sector including 3i’s investment in Attero of £354m driving the value in Q2 2018. This year has been a relatively quieter year in terms of larger deals (required to be announced), an important distinction to make as smaller private transactions are not required to be reported. The value of deals disclosed has been significantly impacted by the reduction in publically available information.

However, we are aware of a level of activity at the smaller consolidation level that is continuing with regional operators making acquisitions. The value in Q1 is driven primarily by Biffa’s acquisition of SWRnewstar and Q3 is driven by the sale of Renewi PLC’s Canadian operations – in most cases acquirers are keeping their deal values private. 2019 data excludes December with a number of deals in the market place that could move the value and volume up.

The level of activity we have experienced in 2019 does not show a significant reduction suggesting the market has moved to smaller consolidation deals for now, which will be picked up only as key players file their annual accounts. The long run average for the sector has been around 40 announced deals per year, so we would expect this to bounce back in 2020 and further deals to come to light that took place in 2019.

Outlook for 2020

We consider that there will continue to be appetite for consolidation across the industry. Biffa will be seeking to acquire £25m of revenue to meet its stated targets of 2.5% revenue growth. Enva and Reconomy as well as a number of businesses funded by the BGF will likely continue their investment in the sector. We have seen some potential in the liquid waste sector as well as more advanced recycling businesses seeking investment. We are also aware of rumours of a number of significant regional businesses looking to approach the market.

AUTHOR

Ricky Thomas is an M&A specialist at James Cowper Kreston, accountants and business advisors, and is based in their Reading, Berkshire office.

[cover picture: credit, Shutterstock]

The post ‘Buoyant’ waste market for industry deals in 2019 appeared first on letsrecycle.com.

Source: letsrecycle.com Waste Managment