A report commissioned by CIWM has warned of the possible ramifications of Brexit on the refuse derived fuel (RDF) sector and addressed “uncertainties” about the future of the industry.

Published last week, ‘RDF trading in a modern world’ marked the inauguration of CIWM’s 2018/19 President Enda Kiernan. It was carried out by environmental consultancy, SLR Consulting Ltd.

The report explores the landscape for RDF exports from the UK and the Republic of Ireland and models possible future scenarios, taking into account factors including the impact of Brexit on markets.

Uncertainty

The report described RDF export as “valuable interim role” in diverting material from landfill, in lieu of domestic energy from waste (EfW) capacity.

However, due to the “high degree of uncertainty” in factors affecting the market, “it is not possible to project the exact future scale of RDF exports with confidence,” the report notes.

“The position of UK exports is somewhat precarious, being dependent on the Brexit outcome, and future national recycling performance,” it states

In the report, SLR warns that the Brexit process could result in the practice of exporting RDF becoming “less economic”.

Two concerns are raised in relation to Brexit: Imposition of tariffs on RDF imports and increased friction to RDF movements due to the imposition of customs controls.

“While it looks likely that tariffs will not apply to RDF, an onerous customs regime would add to transport times and administrative burdens,” explains SLR director Alban Forster.

Last month, letsrecycle.com reported that shortages of European hauliers willing to come to the UK is already hitting exporters of recycled materials to the continent (see letsrecycle.com story).

The report warns: “In the event that new customs arrangements cause a major obstruction to imports, the result could be increased stockpiling of RDF and possible feedstock deterioration, penalties for delays under ‘Put or Pay’ contracts and currency fluctuations, given that the majority of contracts are in euros. Any significant stockpiling resulting from border disruption could also result in regulatory breaches and increased waste crime.”

According to CIWM executive director, Chris Murphy, the UK Government “can help to limit these impacts by pressing for continuing free movement of RDF, regardless of the ultimate outcome of Brexit negotiations”.

The report states that greater long term policy certainty is “essential” to allow the sector to adapt as the export market evolves.

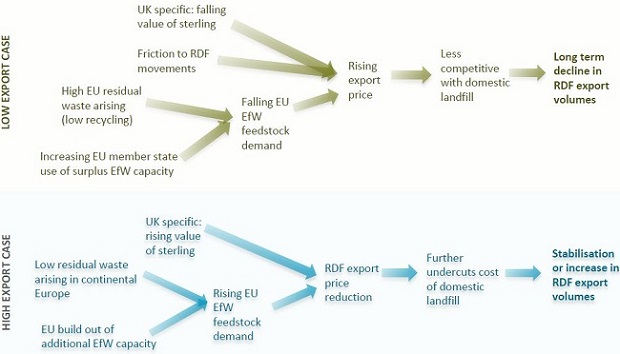

Below: A diagram illustrating the interactions influencing demand for RDF export (Graphic: CIWM)

Recycling

Further to Brexit, the report outlines that recycling levels will have a big impact on RDF export. The report states: “The future scale of RDF exports is critically sensitive to the ultimate recycling level achieved in the UK. It remains to be seen whether the new resources and waste strategy (indicated by Defra as to be released later this year) will reduce uncertainty in this regard.”

Overall, SLR forecasts that in the event that the EU Circular Economy Package (EU CEP) requirement for 60% recycling is achieved, RDF exports will “contract dramatically”.

In terms of the regional picture, Northern Ireland currently places the greatest reliance of RDF exports (circa 80 kg/person/yr). This position is likely to continue until domestic EfW capacity is delivered in NI, the report notes.

Meanwhile, in Scotland RDF exports may provide a cost effective short term solution to councils achieving the Scottish Government’s 2021 ban on landfill of biodegradable waste.

In England, the long term outlook for exports is “highly dependent” on the municipal waste recycling rate achieved. And, build out of domestic EfW capacity will reduce remaining volumes of residual waste, intensifying competition with landfills to secure feedstock.

Risks

CIWM’s Chris Murphy continued: “CIWM has been keeping a close eye on developments, and liaising with Defra as they work to ensure that regulatory alignment is maintained post-Brexit, even in the event of a no-deal scenario. However, other factors such as border controls and delays, and haulage costs, could also adversely affect the economics of RDF export.

“Regulators across the UK will need to be alert to a number of risks in the event of significant disruption, including stockpiling and a greater risk of waste crime.”

Related links

CIWM report

RDF Conference

29th November 2018

Congress Centre, London

www.rdfconference.com

The post Brexit impacts on RDF market highlighted by CIWM appeared first on letsrecycle.com.

Source: letsrecycle.com Waste Managment